Read this article if you’re wondering what a Merchant Chargeback Protection is. This insurance policy for payment processors can help limit your losses, identify anomalies, and analyze chargebacks. Learn why merchants need it! In this article, you’ll discover how it works for you. In case you’re wondering if you need it, read on! Despite its name, merchant chargeback protection can be a valuable investment.

Chargeback protection is a payment processor’s insurance policy.

While it may not seem necessary to purchase merchant chargeback protection for your business, it is a smart move. This insurance policy reimburses you for chargebacks when you have been unable to recover them from the customer. However, chargeback insurance does not protect you from friendly fraud, rising. Look at your chargeback ratio to determine whether chargeback insurance is right for you. If this number is too high, you may find yourself in trouble.

Whether or not you need it, merchant chargeback protection depends on what type of business you run and your customers’ needs. Chargeback protection can help you fend off fraudulent charges and protect your business. However, different chargeback types require different solutions. For example, measures taken against actual fraud include:

- Asking for the card certification value.

- Requiring address verification.

- Drawing personal attention to transactions.

The best chargeback protection plans will offer you a combination of fraud prevention and protection.

Helps Limit Losses.

A comprehensive chargeback prevention strategy is essential to limit the number of losses from fraudulent transactions and mainly stop chargebacks. Unfortunately, chargeback regulations are based on pre-internet marketplace rules and haven’t been updated for the internet-based marketplace. Because of this, prosecutors aren’t as equipped to deal with chargeback fraud as they once were. Fortunately, fraud prevention providers can provide comprehensive solutions to help merchants combat the threat of chargeback fraud.

Because chargeback fraud can range from innocent to criminal, merchants need a robust chargeback solution to avoid these costly losses. A powerful chargeback scoring solution can detect fraudulent transactions before they happen and limit false positives. Unfortunately, many merchants are not aware of how much money they’re losing because they’re blocking legitimate customers from making purchases. As a result, they often fail to recognize the true costs of fraudulent activity. With this protection, they can avoid the loss of thousands of dollars.

Identifies Anomalies

The process of identifying anomalies in chargeback transactions is not easy. It requires a comprehensive approach to fight multiple points of fraud. First, merchants must choose a PSP that can combat multiple fraud points. A holistic approach to chargeback fraud combats fraud by combining technologies and multiple experts. In this way, merchants can use payments to their advantage. It can make a significant difference in marketing, customer retention, brand reputation, and everything else that makes a business tick.

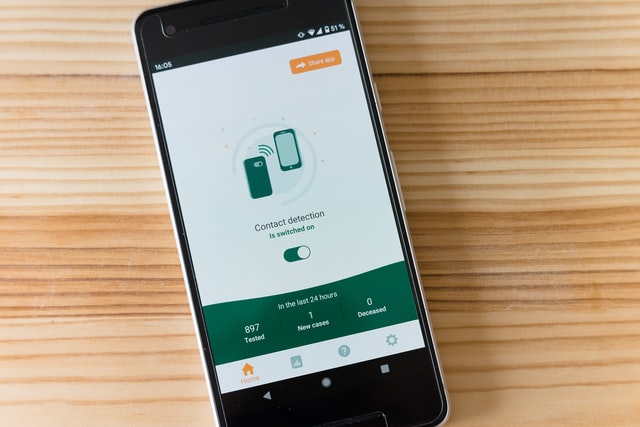

The European Payment Services Directive (PSD2) makes payment service providers (PSPs) responsible for fraudulent chargebacks against merchants. To reduce this cost, PSPs are obliged to implement Secure-Customer-Authentication technologies. Often, PSPs are reluctant to combat chargeback fraud despite their legal responsibilities, but by offering low-fee protection, merchants can significantly reduce the risk of chargeback fraud.

It Analyzes Chargebacks

The ability to manage chargebacks is crucial to the success of your online business. According to one study, merchants in the U.S. lose 1.32% of their revenue due to chargebacks, which equals billions of dollars. Chargebacks cost merchants money, but they can also damage their reputation with customers and banks.

Whether a chargeback is the result of friendly fraud or a genuine error on the merchant’s part, preventing them is critical. A merchant must analyze the chargeback data carefully to determine the true cause. Despite what many consumers assume, it is important to note that chargeback reason codes do not always correspond to the underlying reality. For this reason, merchants must analyze their chargeback data thoroughly to determine the true causes of these disputes.

Helps Prevent Fraud.

Whether you run a small or large business, chargeback fraud is a reality. Unfortunately, even though it’s unfortunate, chargeback fraud is a fact of life. Sixty-six billion transactions will generate 33 million disputes by 2022. While they’re not exclusive to certain industries, they can drastically reduce your revenue.

Most chargebacks are caused by various reasons, including poor customer service, unclear or non-existent merchant descriptors, and insufficient fraud prevention methods. Chargebacks can occur in any industry, and different types of merchants may experience different numbers. The best way to prevent fraud is to track chargebacks back to their origin. Each chargeback has a reason code, which will allow you to determine what caused the chargeback.

Leave a Reply