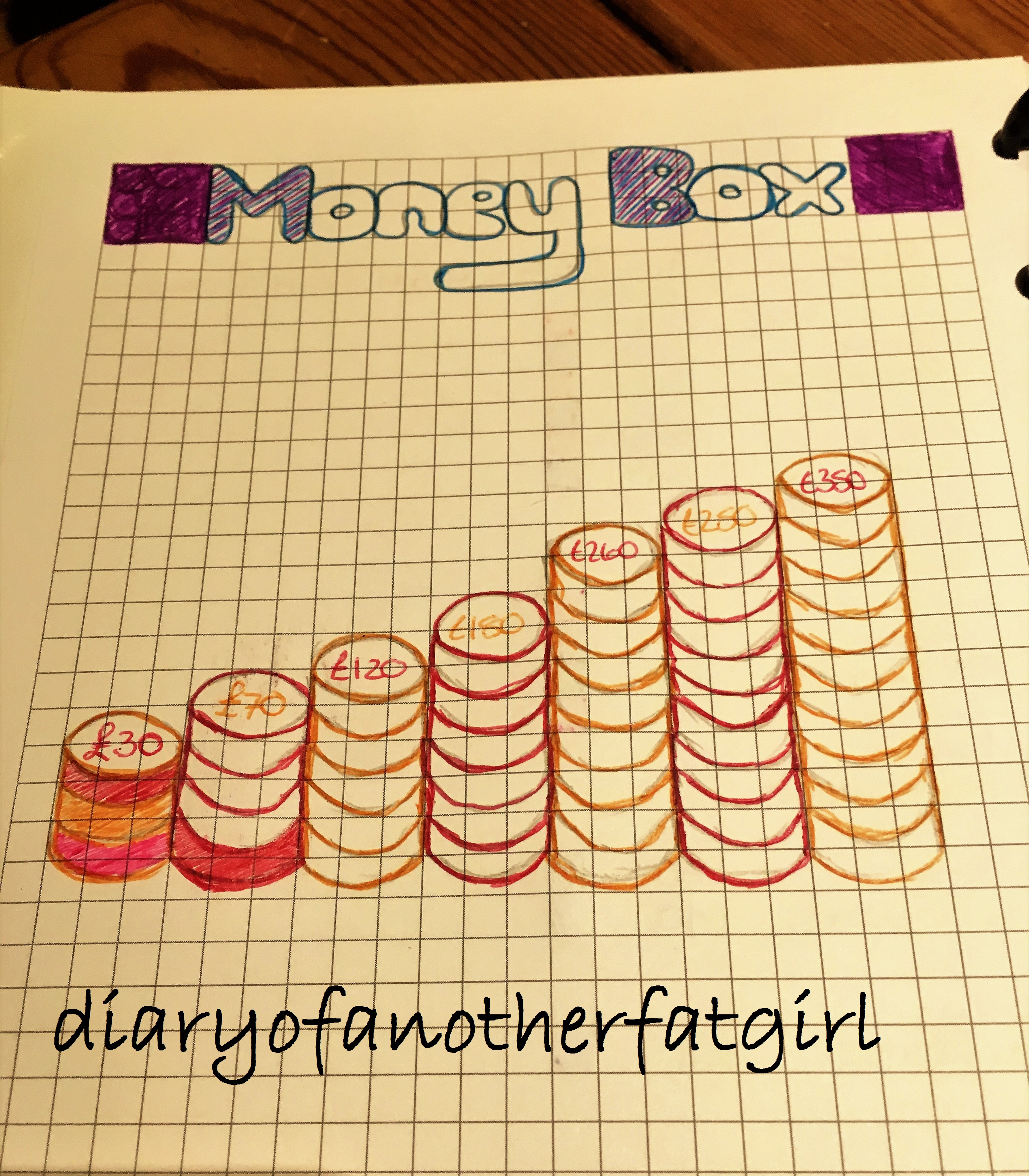

My last post was about how I use my Bullet Journal for tracking my finances. In that post I mentioned that I use an app called moneybox.

This app is a savings app that allows you to put money into as ISA but in a much simpler way.

When you set the app up you get to chose between three different savings options with varying risk levels:

Adventurous (High Risk) – 60% Global Shares Fund, 35% Property Shares Fund, 5% Cash Fund.

Balanced (Medium Risk) – 45% Global Shares Fund, 25% Property Shares Fund, 30% Cash Fund.

Cautious (Low Risk) – 10% Global Shares Fund, 5% Property Shares Fund, 85% Cash Fund.

As you can probably work out Cash is the safest option followed by property and then Global shares.

What makes is Simple?

Well basically instead of having to think too much about saving and worry about making large deposits, you link the app to your bank account. It then shows you a list of all your transactions and gives you the option to round them up

So if you spend £2.80 on a coffee you can round up to £3.00 and the 20p will go into your ISA. Now 20p here and there doesn’t sound much but it soon adds up. It then takes whatever you have rounded up that week out of your bank in one go. So your saving little and often.

Mr Experience.

I have had the app about three months now and have saved £209.56. I have made 1.89% but as some points it has reached 5%. The markets do seem very volatile at the moment and I am on the high risk option so it does change often. It may not seem like a huge amount but I have never managed to save anything before as I always end up taking out so this is a really good way of doing it.

Can I take my money out?

Of course, the money is still yours and you can withdraw some or all of your money whenever you want. Withdrawals are meant to take around 3-4 working days. Luckily I have been a very good girl and have left mine alone so I can’t verify if this deadline is met.

So if you struggle to save like me give the money box app a go and see if it helps.

Leave a Reply