This is the second most in my series about Bullet Journals, this one focuses on how to use your Bullet Journal for tracking your finances.

One of the main reasons I started Bullet Journaling was to help track my debt repayments. This is an area that we are really focusing on as a family at the moment.

The front page of my finance section contains a quote to keep me motivated which is:

‘Become so financially secure that you forget it’s payday’

This is something we definitely want to achieve but are miles away as it stands. Pay day is Friday and we are desolate, but we are on track which is the point.

Next is the Total debt page which tracks how much we manage to pay off each month in large coloured blocks, kind of like tetris. When we started in February 2016 it was at £22,824.31 and it is now on £17,324 which I am happy with as far as progress goes. It’s so satisfying filling in a large block when you have a good month.

Then I have pages for individual debts, one for each of my three large Credit cards and one that combines all the small debts. The small debts page is rewarding and good for focusing on clearing one at a time.

I then have a bills tracker which is a simple list of bills that I tick of each month.

I have recently added two pages since our financial situation has started to improve:

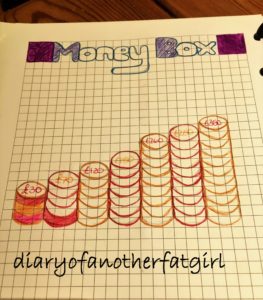

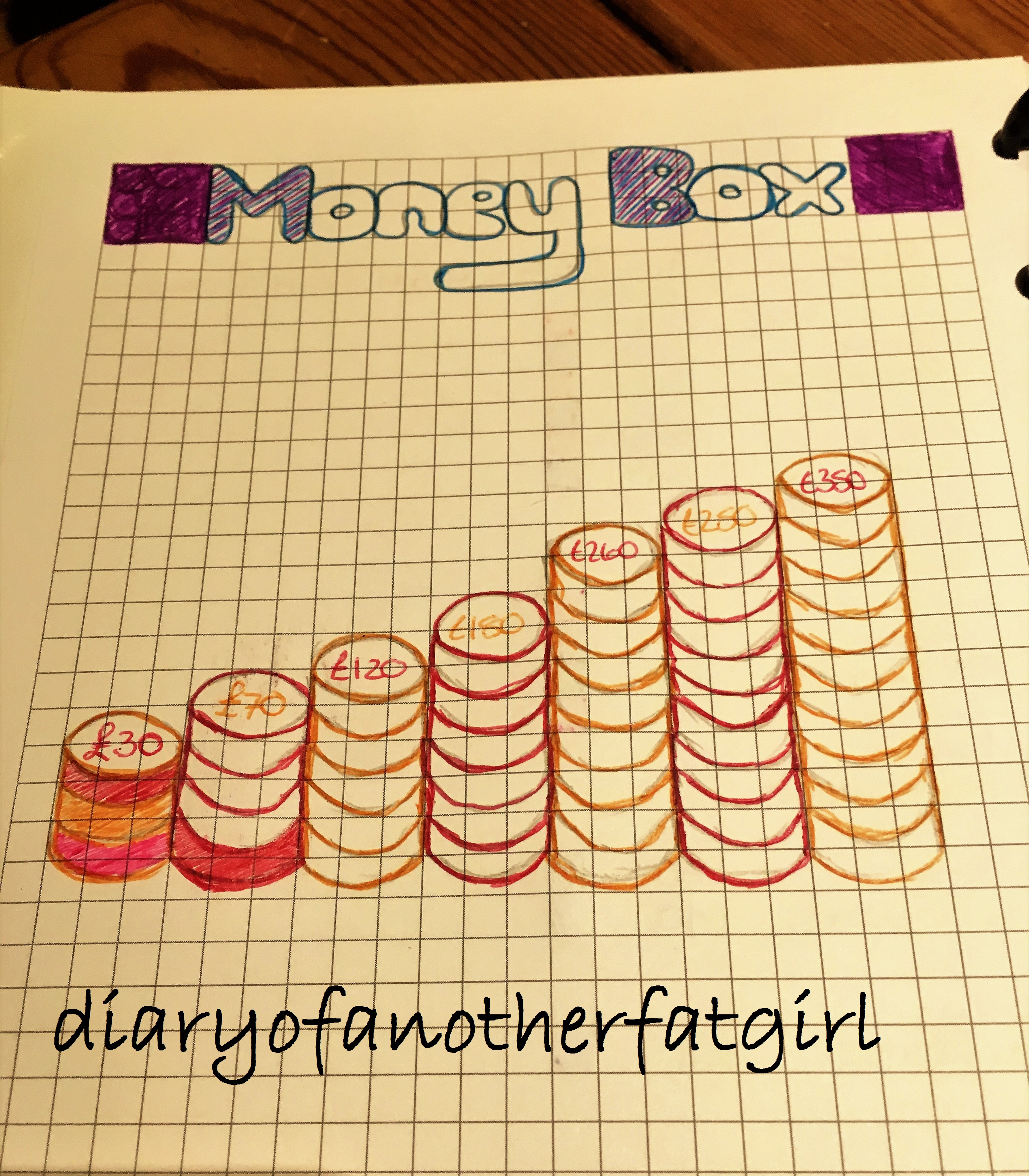

Money Box App – This tracks mt ISA savings which I have through the money box app. I will write another post about this App as it has been really good for us.

Then we have an overtime tracker for my partner’s job. Unfortunately I can’t work overtime but I do make a bit online that I should start tracking more closely. When I got this I will write about it as I can imagine it would be useful to many on here.

We then have the dreaded Credit score graph which is self explanatory,

The final page is a wishlist, If we get the urge to buy something that would be classed as treat or a luxury we list it here. If we still want it after a few weeks then we can budget the money for it. If we don’t then we haven’t wasted out money on it.

Have any questions about how any of these trackers work feel free to ask questions 🙂

Leave a Reply